ASIFMA India Capital Markets Week 2021

ASIFMA India Capital Markets Week

Tuesday-Thursday, 7-10 December, 2021, Virtual Event

Overview of the Event

Join us from 7-10 December 2021, for our final virtual conference of the year – India Capital Markets Week! The objective of the event is to identify key challenges that the industry is facing globally and within Asia, with the aim to bring market participants together to help solve them.

Growing deep and liquid capital markets in India is at the top of the agenda for Indian regulators, policy markers and market participants, and in recent years, significant strides have been made to accelerate reform. Nonetheless, there is scope for improvement across areas ranging from broader market structure reform to legal and regulatory constraints. Ultimately, the goal is to work towards ensuring that the optimal terms and amount of funding required is available to both the private and public sectors, which is paramount to ensure that India continues to transform and grow its economy.

Dates: Tuesday-Friday, 7-10 December 2021

Time: Starting from 10:00am (IST) / 12:30pm (HKT/SGT) daily (Time Zone Converter)

Format: Virtual

Language: English

Key Themes / CPT Hours

Assessing India Markets (CPT 3.5 hours)

Day 1 (Tuesday, 7 December)

10:00-13:40 (IST)/12:30-16:10 (HKT/SGT)

Equities and Post Trade (CPT 3 hours)

Day 2 (Wednesday, 8 December)

10:00-13:00 (IST)/12:30-15:30 (HKT/SGT)

Fixed Income and FX (CPT 3 hours)

Day 3 (Thursday, 9 December)

10:00-13:40 (IST)/12:30-15:30 (HKT/SGT)

Operating in India (CPT 3 hours)

Day 4 (Friday, 10 December)

10:00-13:00 (IST)/12:30-15:30 (HKT/SGT)

*To qualify for the CPT hours mentioned above, participants are required to attend the entire event on each day.

Lead Sponsors

Platinum Sponsors

Gold Sponsors

Event Manager

At ASIFMA, we are committed to ensuring diversity and inclusion in our workplace and this policy is applied in all areas of our business including speaker roles at our events and conferences. We wish to work with members and partners who share this same commitment and are willing to support this policy.

Agenda

Download the agenda

ACCESSING INDIA MARKETS - TUE 7 DECEMBER, 2021

DAY 1 – TUESDAY, 7 DECEMBER 2021

ACCESSING INDIA MARKETS

10:00-10:02 (IST) / 12:30-12:32 (HKT/SGT)

Welcome Remarks

Mark Austen, CEO, ASIFMA

10:02-10:05 (IST) / 12:32-12:35 (HKT/SGT)

Opening Remarks

Badri Nivas, Managing Director, Country Treasurer & Head – Markets & Security Services, Citibank

10:05-10:20 (IST) / 12:35-12:50 (HKT/SGT)

Opening Keynote

Anand Mohan Bajaj, Additional Secretary, Minister of Finance of India

10:20-11:05 (IST) / 12:50-13:35 (HKT/SGT)

Panel 1: India’s Macros and Micros – Setting the Scene

- What has been the impact of Covid-19 on the India capital/financial market and what is the future prospect for recovery and return normalcy? What will be the needs of India for capital (both equity and debt) from foreign investment in the next 3 to 5 years?

- How is India continuing to reform its markets to attract global investment as it emerges from Covid-19 in a landscape where EM and Developed markets will be all competing heavily for scarce capital? What are some of the recent and expected key market and regulatory developments? What has been the impact on foreign flows recently and expected in the future?

- What do global investors need to see to grow their investments in India?

- What do banks require to grow their operations in India?

- How is tech changing India markets if at all?

Panelists:

Kenneth Akintewe, Head of Asian Sovereign Debt, Asian Fixed Income, abrdn

Dr. Samiran Chakraborty, Managing Director and Chief Economist – India, Citigroup

Rajesh Gandhi, Partner, Deloitte Haskins & Sells LLP

Moderated by: Mark Austen, CEO, ASIFMA

11:05-11:50 (IST) / 13:35-14:20 (HKT/SGT)

Panel 2: Accessing India from Offshore: A Focus on FPIs, AIFs and Brokerage firms

- Overview of the various access channels

- Recent developments that have smoothened access for offshore investors to the onshore liquidity pool

- Remaining regulatory, tax and practical challenges and recommendations to resolved these

Panelists:

Akshay Thakurdesai, Head of Securities Services India, BNP Paribas Securities Services

Vivek Sharma, Head International Clients Group, Edelweiss Wealth Management

Sunil Badala, Partner, KPMG

Nehal D Sampat, Associate Partner, Price Waterhouse & Co LLP

Yash Bansal, Partner, Trilegal

Moderated by: Laurence Van Der Loo, Executive Director, Head of Technology and Operations, ASIFMA

11:50-12:35 (IST) / 14:20-15:05 (HKT/SGT)

Panel 3: International Financial Services Centre (IFSC) at GIFT City

- Recent regulatory changes in IFSC

- Setting up on GIFT City – practical experiences

- Advantages of setting up GIFT-IFSC

- Remaining challenges from a practical, regulatory, tax perspective

Panelists:

Dipesh Shah, Executive Director, Development, International Financial Services Centres Authority

Anupam Verma, Head, International Banking Unit IFSC GIFT City, ICICI Bank

Ravi Varanasi, Group President, National Stock Exchange of India Limited

Tushar Sachade, Partner, Price Waterhouse & Co LLP

Richard Pattle, Cofounder and CEO, True Beacon

Moderated by: Shruti Rajan, Partner, Trilegal

12:35-13:20 (IST) / 15:05-15:50 (HKT/SGT)

Panel 4: ESG & Sustainable Finance in India

- Policy Environment in India – climate change, environmental standards

- ESG requirements for India-listed Companies

- Disclosure standards in India

- Climate related risk management in India

- Building blocks for developing Sustainable Finance in India

Panelists:

Sean Kidney, CEO, Climate Bonds Initiative

Alex Cooper, Lawyer – Corporate/Finance and Climate Change, Commonwealth Climate and Law Initiative

Martijn Hoogerwerf, Head of Sustainable Finance Asia-Pacific (ad interim), ING

Deepak Khurana, Propositions Sales Director, Sustainable Finance, Refinitiv, an LSEG Business

Priyanka Dhingra, Senior Manager, ESG Research (Investments), SBI Funds Management

Moderated by: Sivananth Ramachandran, CFA, CIPM, Director of Capital Markets Policy, India, CFA Institute

13:20-13:35 (IST) / 15:50-16:05 (HKT/SGT)

Closing Keynote

Shri Ananta Barua, Whole-Time Member, Securities Exchange Board of India (SEBI)

13:35-13:40 (IST) / 16:05-16:10 (HKT/SGT)

Closing Remarks

Mark Austen, CEO, ASIFMA

EQUITIES AND POST TRADE - WED 8 DECEMBER, 2021

DAY 2 – WEDNESDAY, 8 DECEMBER 2021

EQUITIES AND POST TRADE

10:00-10:02 (IST) / 12:30-12:32 (HKT/SGT)

Welcome Remarks

Lyndon Chao, Managing Director – Head of Equities and Post Trade, ASIFMA

10:02-10:05 (IST) / 12:32-12:35 (HKT/SGT)

Opening Remarks

Anju Abrol, Head of Wholesale Banking, Asia Pacific, ING

10:05-10:20 (IST) / 12:35-12:50 (HKT/SGT)

Opening Keynote

Vikram Limaye, Managing Director, CEO, National Stock Exchange of India (NSE)

10:20-11:00 (IST) / 12:50-13:30 (HKT/SGT)

Panel 1: Primary Markets – ECM and IPOs

- India bull market, 2021 a record year for IPO’s and a magnet for FPIs

- Record number of India tech start-ups entering the Unicorn club

- IPO reforms paying off – streamlined IPO application process, shorter listing cycles, relaxation around lock in periods

Panelists:

Jibi Jacob, Managing Director & Head Capital Markets, Investment Banking, Edelweiss Wealth Management

Rachana Bhusari, Head Primary Market Business Development, National Stock Exchange of India (NSE)

Mohan Bhuyan, India Representative – Primary Markets, London Stock Exchange, Capital Markets, LSEG

Moderated by: Rajat Agarwal, Asia Equity Strategist, Societe Generale

11:00-11:50 (IST) / 13:30-14:20 (HKT/SGT)

Panel 2: Secondary Markets – Trading

This session will be covering success stories during the time of the pandemic, but also how businesses need to come back to normal to further the growth potential in the market.

- Evolution of the Indian Markets

– Stampeding herd of millennials piling into India’s stock market as Sensex hits new highs

– Fintech democratizing algo trading for the masses - Indian Capital Markets, Strengths and Weaknesses from the Foreign Participant Perspective

- Product Development – Where Next for Derivatives: FX, Digital Assets, etc.

Panelists:

Arbind Maheswari, Managing Director and Head of India Equities, BofA Securities

Jonathan Finney, Head of Global Equity Development, Citadel Securities

Shiv Sehgal, President and Head of Institutional Securities, Edelweiss Wealth Management

Hari K, Chief Business Officer, National Stock Exchange of India Limited

Moderated by: Winnie Khattar, Head of Market Structure, BlackRock

11:50-12:35 (IST) / 14:20-15:05 (HKT/SGT)

Panel 3: Post Trade and Custody *Closed to Media session*

- The sprint towards T+1, and balancing benefits vs the challenges

- Demystifying CCP Issues in India

- “Post Impact Analysis” of past regulatory changes and initiatives

Panelists:

Vaisshali Babu, Associate Director, Securities Services – India, BNP Paribas

Andrew Peretti, Equities Trader, Fidelity

Piyush Chourasia, Chief Risk Officer & Head – Strategy, ICCL

Sujit Kadakia, Managing Director, Head of India Office, Societe Generale Securities India

Moderated by: Aditya Sharma, Managing Director and Head of Securities Services South Asia, Citibank

12:35-12:40 (IST) / 15:05-15:10 (HKT/SGT)

Closing Remarks

Lyndon Chao, Managing Director – Head of Equities and Post Trade, ASIFMA

FIXED INCOME AND FX - THU 9 DECEMBER, 2021

DAY 3 – THURSDAY, 9 DECEMBER 2021

FIXED INCOME AND FX

10:00-10:02 (IST) / 12:30-12:32 (HKT/SGT)

Welcome Remarks

Philippe Dirckx, Managing Director – Head of Fixed Income, ASIFMA

10:02-10:05 (IST) / 12:32-12:35 (HKT/SGT)

Opening Remarks

Ranjit Pawar, Head of Sales South Asia, Refinitiv

10:05-10:20 (IST) / 12:35-12:50 (HKT/SGT)

Opening Keynote

Dimple Bhandia Chief General Manager, Reserve Bank of India (RBI)

10:20-11:05 (IST) / 12:50-13:35 (HKT/SGT)

Panel 1: Debt market development and index inclusion

- Index inclusion: where do we stand?

- Streamlining the access channels

- Simplifying tax regime and other regulatory requirements

- Bond issuance and on/off-the-run liquidity

- Developing the credit bond and CDS market

- Short selling and Securities Borrowing and Lending

- Broadening the international investors’ access to various asset classes and hedging/funding tools

Panelists:

Alastair Gilmour, Fixed income & Trading, Capital Group

Badri Nivas, Managing Director, Country Treasurer & Head – Markets & Security Services, Citibank

Tim Batho, Chief Strategist, Index Policy, Asia Pacific, FTSE Russell

Balaji Balasubramanian, Partner, Financial Services, Tax & Regulatory Services, PricewaterhouseCoopers Private Limited

Moderated by: Philippe Dirckx, Managing Director – Head of Fixed Income, ASIFMA

11:05-11:50 (IST) / 13:35-14:20 (HKT/SGT)

Panel 2: FX, Funding & Hedging

- Does offshore activity still create instability in the onshore rate?

- What prevents investors from managing their risk/exposure onshore?

- What can be done to generate deeper liquidity in the domestic market?

- What impact do product restrictions have for market participants ability to hedge and fund their domestic exposures?

- Is the domestic Repo market an effective source of funding?

Panelists:

Nathan Venkat Swami, Asia Pacific, Head of FX Trading, Citibank

Utkarsh Sharma, Head – Trading, Global Emerging Market, Deutsche Bank, India

Soumyo Dutta, Group Treasury Head, Reliance

Vaneet Gupta, Head, FX Trading, Standard Chartered Bank

Moderated by: John Ball, Managing Director – Global FX Division – Asia Pacific, GFMA

11:50-12:55 (IST) / 14:20-15:25 (HKT/SGT)

Panel 3: Developing India’s Green Bond Market

- Why does India need a green bond market? How is this same or different to green lending?

- What are the constraints – is their demand from issuers, and is the met by demand from investors?

- What role can regulation play to help develop this market? What else needs to happen from a regulatory

Panelists:

Andrew Ashman, Head of Loan Syndicate, Asia Pacific, Barclays

Royston Braganza, CEO, Grameen Capital India

Shoaib Ahmed, Director, Global Capital Markets, ING

Moderated by Mushtaq Kapasi Managing Director, Chief Representative Asia-Pacific, International Capital Market Association (ICMA)

12:40-12:55 (IST) / 15:10-15:25 (HKT/SGT)

Closing Keynote

Royston Braganza, CEO, Grameen Capital India

12:55-13:00 (IST) / 15:25-15:30 (HKT/SGT)

Closing Remarks

Philippe Dirckx, Managing Director – Head of Fixed Income, ASIFMA

OPERATING IN INDIA - FRI 10 DECEMBER, 2021

DAY 4 – FRIDAY, 10 DECEMBER 2021

OPERATING IN INDIA

10:00-10:02 (IST) / 12:30-12:32 (HKT/SGT)

Welcome Remarks

Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA

10:02-10:05 (IST) / 12:32-12:35 (HKT/SGT)

Opening Remarks

Balaji Balasubramanian, Partner, Financial Services, Tax & Regulatory Services, Pricewaterhouse Coopers Private Limited

10:05-10:20 (IST) / 12:35-12:50 (HKT/SGT)

Opening Keynote

Will Obeney, First Secretary, Financial Services and Acting Head of Economics and Finance, Foreign,

Commonwealth and Development Office

10:20-11:05 (IST) / 12:50-13:35 (HKT/SGT)

Panel 1: India’s Data and Privacy Requirements *Closed to media*

- Regulatory landscape – what is the overall data regulation framework in India, and what are its objectives?

- What are the key challenges posed by this approach on financial services firms?

- How do other jurisdictions approach the same policy objectives?

Panelist:

Elizabeth Purcell, Regional Technology Counsel, Asia Pacific, Bank of New York Mellon

Anand Krishnan, Manager, Policy, Data Security Council of India (DSCI)

Anoop Vasu, Senior Legal Counsel, Standard Chartered Bank

Bill Block, Treasury Attaché, US Embassy India

Moderated by: Nikhil Narendran, Partner, Trilegal

11:05-11:50 (IST) / 13:35-14:20 (HKT/SGT)

Panel 2: Technology adoption in India’s capital markets: State of play

- Leveraging public cloud in India

- DLT adoption India’s capital markets

- Leveraging the India stack for capital markets

- Crypto crackdown versus India’s CBDC plans

Panelists:

Bikram Bedi, Managing Director, Google Cloud India

Kumar Goradia, Partner, Anapro Strategies LLP

Ashish Kabra, Head – Singapore Office, Nishith Desai Associates

Meghavi Chauhan, Assistant Vice President, Technology Innovation, Refinitiv, an LSEG Business

Moderated by: Laurence Van der Loo, Executive Director, Head of Technology and Operations, ASIFMA

11:50-12:35 (IST) / 14:20-15:05 (HKT/SGT)

Panel 3: Tax considerations for India – On the Cusp of Fundamental Changes

- International tax developments (OECD BEPS Pillars 1 & 2) – impact on India capital markets

- Tax policy outlook for India – equalization levy, bond index inclusion and other key asks

- IFSC – have we onshored the offshore?

- ES’G’ tax disclosures – the evolving approach towards transparency

Sunil Kothare, Senior Tax Counsel, HDFC Bank

Amit Patwardhan, Head of Tax (India), HSBC

Marc Marriner, Executive Director, JP Morgan

Amit Phulwani, Partner – Tax and regulatory, KPMG

Moderated by: Sanjay Tolia, Partner, Price Waterhouse & Co LLP

12:50-12:55 (IST) / 15:20-15:25 (HKT/SGT)

Closing Remarks

Laurence Van der Loo, Executive Director, Head of Technology and Operations, ASIFMA

If you wish to effectively engage an esteemed audience and connect with the global and regional community at our other events, various sponsorship packages with speaking slot inclusion and advertising opportunities are open to ASIFMA members and non-members for more brand and marketing exposure as well as increasing lead generation. For further details, please contact us at event@asifma.org).

Lead Sponsors

Platinum Sponsors

Gold Sponsors

Endorsers

Media Partners

Event Manager

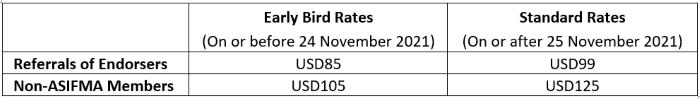

Delegate Fee

CPT Hours:

- Day 1 (Tuesday, 7 December): Assessing India Market (CPT 3.5 hours)

- Day 2 (Wednesday, 8 December): Equity and Post Trade (CPT 3 hours)

- Day 3 (Thursday, 9 December): Fixed Income and FX (CPT 3 hours)

- Day 4 (Friday, 10 December): Operating in India (CPT 3 hours)

To qualify for the CPT hours mentioned above, participants are required to attend the entire event on each day.

Disclaimer :

Should you choose to attend this virtual event which is organised by ASIFMA, attendance rosters will be made available to both ASIMFA and our event sponsors so that we can inform you of future events and services that may be of interest to you.

Confirmed Speakers

Reference Materials

ING

National Stock Exchange of India Limited (NSE)

Breakingviews

Breakingviews is pleased to be a media partner and to offer you a three month complementary access to Breakingviews, which is the financial commentary brand of Reuters News. Breakingviews delivers agenda-setting financial insight on the major financial stories as they break across the global and so keeps readers better informed. Click this Link to register for a complementary access.

For event enquiries, please contact event@asfima.org or phone +852 2531 6532.